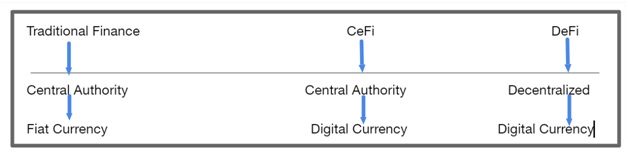

Many of us don’t know, but there are two types of finances keeping the cryptos operational: DeFi and CeFi.

Investors use mostly DeFi to buy and sell crypto and various digital assets. In fact, DeFi technology is gaining so much popularity that every other marketplace wants DeFi to strengthen it. This is why they rely on the most capable DeFi development company or hire capable DeFi developers.

Unlike traditional centralized entities (banks), these are decentralized and provide pseudo-anonymity to access necessary funds and make a transaction.

Though they sound futuristic, DeFi and CeFi are different from each other in every aspect.

So why not dig a little and find out what they are, why they are used, and the key differences they have?

But before that, let’s understand the traditional finance system.

Traditional Finance

Traditional finance encompasses centrally or semi-centrally authorized bodies like banks, insurance companies, stock exchanges, and other financial institutions. And this whole financial service depends on the value of a particular currency, such as the US dollar.

In traditional finance, everything is monitored, controlled, and tracked. So if a user makes a transaction, it’s not hidden, and it can be controlled or even manipulated by these central authorities or institutions.

In other words, users don’t have full custody and control over their accounts or assets, and they can be seized by any governing body if permitted. So the users have no choice but to rely on and trust these bodies to keep their assets and money safe.

However, these third parties carry serious risks such as money laundering, fraud, poor management, and theft.

DeFi (Decentralized Finance)

If we remove all the centrally governed bodies like banks, insurance companies, and stock exchanges from traditional finance and replace them with a blockchain and add smart contracts on top of it, then it becomes a DeFi system.

DeFi came with the purpose of powering finance technology over the decentralized distributed ledger using smart contracts (a set of codes that execute a particular task automatically if the assigned conditions are met).

This finance system offers users full control, custody, and management over their digital assets. This means no third party or any governing authority can manipulate the assets or goods without the user’s permission.

DeFi transactions are not dependent upon any central authority, such as a financial institution that acts as an intermediate transaction guarantor.

Furthermore, it follows three main characteristics; transparency, control, and accessibility, which allow a user to look into its method of operation, and how it works. for instance, the automated task execution of smart contracts.

Key Elements of DeFi

Decentralized finance is made up of four key elements.

Blockchain

Blockchain is a platform that powers decentralized transactions. It’s nothing but a distributed ledger over a massive network of computers.

Since it’s not governed, users can manage their accounts on their own and can get insights into every other user’s state of account and transaction history for better transparency and to avoid any unethical activities.

Another good thing about blockchains is, they are permissionless. If there is no authority to stop a user from making transactions, he can benefit from the maximum return.

Assets

The assets are nothing but crypto coins, which are transacted through the blockchain. There are multiple types of crypto, but only some of them possess a stable value such as stablecoin.

Protocols

Protocols, such as a smart contract, are the elements that automate the DeFi process. The smart contract is nothing but a set of codes that executes a particular task if the assigned conditions in the agreement are met.

Use Cases

Now that we have all sorts of comfort to do business through the DeFi system the only remaining thing is its applications.

DeFi is currently used for transferring crypto between two parties as soon as the conditions of the agreement are met. This means users can now borrow, lend, and transfer crypto without relying on a central authority.

CeFi (Centralized Finance)

At this point, you now know everything about DeFi, and this makes it easy to describe CeFi, as we have covered 90% of the CeFi concepts only in DeFi.

To put it simply, CeFi is just another form of DeFi with centralized authority, and that’s the only difference they have as a different finance technology.

Binance, Coinbase, and Kraken are a few of the CeFi companies that provide users with centralized financial services and help users get comfortable with CeFi.

From this, we can say, CeFi sits in the middle of traditional finance and DeFi, or slightly towards DeFi.

CeFi is highly recommended if you are a beginner in the crypto world, since it’s easy to get started with.

DeFi Vs CeFi Key Differences

Transparency

Although both DeFi and CeFi operate on blockchain, DeFi is decentralized and CeFi is centralized, which means DeFi offers greater transparency to the users and other parties to avoid any unethical activities.

Custody and Control

As compared to CeFi, DeFi offers users greater custody and control over their accounts and operations. And the reason for this is that CeFi is centralized and may hand over some of the custody and control of users’ accounts to CeFi companies.

Privacy and Anonymity

When you choose CeFi you have to provide some sort of personal info to the CeFi companies just to verify it’s you. However, it raises privacy issues and the chances of your personal details getting stolen. This lowers your anonymity even if you use a blockchain.

Whereas if you use DeFi, you don’t have to provide any personal information, which protects your privacy, and you can be totally anonymous as soon as the crypto and blockchain you use offer you that anonymity.

Gas Fees (Transaction Cost)

Gas fees, also known as transaction costs, are the fees charged by blockchain and DeFi platforms since their consensus mechanisms (proof of work, proof of stake) consume massive power while making the transactions.

However, since CeFi is centralized by companies like Binance, Kraken, and Coinbase, it lets users make transactions without charging any fees.

Risk

Both DeFi and CeFi are risky at points.

For instance, DeFi transactions are not reversible, which means if a user mistakenly transfers money to the wrong account, he can’t get it back. Another risk with DeFi is that if a user forgets his digital key to the DeFi account, then it’s nearly impossible to open a digital account without the key.

Hence, if a user decides to go with DeFi, he will be responsible for all of his actions, including his losses.

On the other hand, CeFi is governed by CeFi companies, which may control and steal some personal information.

However, since it is governed, CeFi companies can help users learn more about CeFi and minimize the risk of transactions, digital keys, and others.

Conclusion

There you have it, a guide for beginners to understand the concept of DeFi vs. CeFi.

Both finance technologies are great if employed by understanding their basics; otherwise, the risks will put users in a grim situation. Also, one should always look at the market before putting himself on the verge of a volatile crypto market to avoid any possible losses.

Looking at the future, there is no doubt both will evolve with new functionalities as there is an abundance of CeFi and DeFi development services available in the market.